|

Module Three |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

There is a limit to the application of democratic methods. You can inquire of all the passengers as to what type of car they like to ride in, but it is impossible to question them as to whether to apply the brakes when the train is at full speed and accident threatens.

Leon Trotsky (1879-1940), Russian revolutionary. The History of the Russian Revolution, vol. 3, ch. 6 (1933).

So what does a government do? Do the goals of government match your expectations? So what does a government do?Before we take a look at what our elected representatives are supposed to be doing, let's summarise what tools have been given to us in a modern society:

1. An

ideology ........

..... Are we all singing the same song? Do we always have to? How would you like the government to think?

2. A

democracy ........

..... is it the kind you would like? Do you take an active part? How would you like to change it? Does it always work? Does the democracy you live with, or dream about lean towards the S in Socialism or the L in Laissez-faire?

But there is something else in the equation? We did not elect our representatives just because we wanted them to have a good time. Why did we elect them? We elected them to meet our needs, as individuals, as communities and as a society. But what do we expect of them; what does a democracy say they should do? Who is it that provides which needs and to whom? Were going to find out soon. In the meantime, in the table below are a number of activities or needs. Choose which services you can afford to provide yourself and which you would like the government to provide:

A government is much the same as a family:Just as families have to budget in order to survive financially, governments need to manage their finances properly or they will end up in trouble. The citizens demand services, so they need to provide them. But the money must come from somewhere... If you recall from Module One, governments base their aspirations on their Ideology. And as you are discovering in this module, the citizens of a country have specific needs and expectations. This is what should be happening:

People's Needs + The government's Ideology should = Service Delivery Are you unhappy about any services at the moment? Discuss your problem with a classmate or the Facilitator.What do you think elected representatives/officials are frightened of when they are unable to satisfy basic needs, or meet demands?Is the provision of houses more important than equipping the defense force, for instance? Who should decide this?When, and where do we hear about the goals of the government?When we speak about Services, what are we talking about?What Types of Services are there?Make a list of three types of services...; try your best to make the list before you scroll down to see what they are.Remember this is course not only about what you know - it's about what you can discover ...

Types of Services

ONE: Order and Protection - To maintain law and order within their jurisdiction, a government has to execute a variety of defined functions and then raise the finance to pay for the costs - the following are some examples of order and protection functions:

TWO: Social Welfare - To encourage individual self development, governments provide these services - how much and how many depends on their ideology. Some countries have a cradle-to-the-grave policy, giving assistance to everyone in any kind of situation, while others are far less socialist orientated and provide only very basic services. England and Canada, for instance have a national health policy (free medical for everyone), while there is a huge debate raging in the USA at the moment with Obamacare - President Obama wanted to give some kind of protection to the 40 million people who have no medical insurance, while many people are against this as they feel it will cost too much... What other services besides something as important as health, for example, should the government provide to some degree?Make a list before scrolling down...

Depending on the Ideology, a government will provide full or partial Social Welfare services for the following:

There will always be some debate as to exactly how far the ruling government should go - if they provide these services fully and satisfy all needs, they will surely be voted into power again, but often this means that they have to borrow heavily to do so. Soon the country is in debt...; explaining that individual citizens should go some way to pay for these services and, in some cases provide most of them themselves in order to save money, is often a very unpopular political stance to take.

But there is a third one. Can you think what it might be? Think, before you scroll down...

THREE: Economic Welfare - This is aimed at the development of the economic and material prosperity of the country and therefore ultimately, the individual. It's all about money... When the economy needs to be stimulated governments tend to relax monetary regulations (bring down interest rates). FYI: Monetary policy is about interest rates, amongst other things. Fiscal policy is about tax. It helps to remember these two terms. At other times when the economy needs to be restricted (such as when people spend too much, or borrow too much), they revise monetary policy (such as when they increase the bank rate and therefore make it more expensive for the citizen to borrow money). There are many ways to regulate an economy. To regulate means to become involved. By now you will gather that a socialist government becomes very involved, and a more laissez-faire government will want to leave the economy alone ... A government may choose to concentrate on different issues in order to stimulate the economy, or to maintain its current growth. From time to time we see the Governor of the Reserve Bank (the bank that lends money to commercial banks), making announcements. S/he tends to raise interest rates when inflation rises and lower interest rates when s/he thinks the economy needs a boost, or encouragement: in other words, the lower the interest rate, the more the economy will growth because people will borrow more and spend more. It is in this way that an economy is regulated, or controlled. In a free market system, the Governor is often very reluctant to interfere too much. In a purely laissez-faire climate some political scientists believe that a government should provide protection to individuals (physical and legal) and should protect contracts. And that they should do nothing else. What do you think? And so the goals of government might be found within the boundaries of the following services that governments seek to provide its citizens:

It is very interesting to note that with many modern democracies the appointment of the Minister of Finance is very often not a political appointment as much as, say the Minister of Education or Health, for instance. In other words most political parties try to make sure, firstly and most importantly, that this ministry is run by someone who is very astute in financial management on a national level; his/her personal political views, should perhaps, come second to this. And the reason for this is, of course, that the effective running of a good strong economy is vital to the overall health of a nation. So where does it all come from? Where does our government find the funds to pay for education, housing and our police force? PLEASE WRITE YOUR NAME DOWN ON A PIECE OF PAPER. NEXT TO THAT WRITE DOWN THE NAME OF YOUR PARTNER. Then, if you have children, write down their names... Take a good look at their names, and if you have a picture look closely at these family members. Then look around you, in the classroom, outside, on the bus, at a station, at work. How many people do you see? All of them have power, and all of them hand over money to the government each day of their lives..., as long as they live. As you realised earlier on in Module Two, it is we who give the government our power to make decisions, by electing representatives (hence the term Representative Democracy). We also give them our money, hopefully to use wisely...

|

|

Personal Income Tax |

Tax on Companies |

Other Taxes |

VAT |

|

38 %

|

16 % up from 13% (2005) |

20 %

|

25 %

|

It is interesting to note that most governments get their income from Personal Income tax - more than from corporate tax. Many years ago, especially in America, the population paid no personal income tax.

If your present government did away with Personal Income Tax, where would you suggest they get the funds from...? Different people might come up with different ideas - ask around.

Look at the table above: Other taxes. What do you think they are?

Make a list before you scroll down. If you are not sure, ask someone what other taxes there might be...

Sources of Income for the Government:

|

Type of Income |

Information and implications: |

|

Personal Income Tax |

Many citizens pay this kind of tax which is based on their income. This means that the more they earn the more they pay, which means this is a progressive tax. Can you think of problems and objections? In the '30's rich Americans were paying up to 90% of their salary in income tax. Today the top rate is seldom above 30%. At the moment people earning less than R63 000 in SA are exempt from paying personal tax or from filling in a tax return. In South Africa this effectively means that the majority of its citizens do not pay personal income tax. In fact only a very small number of income earners carry the entire load ... Do you think this is fair? But before you object remember, there are other taxes they have to pay - can you think what they are? It is possible that non-citizens who earn money in South Africa have to pay tax although they do not have the vote. This effectively means taxation without r.....? Do you think this is fair? When in business, this tax does not apply to the cost of earning the income the cost is deducted from the total income received or earned and is called a deduction.

|

|

Value Added Tax |

Everyone in South Africa pays this kind of tax; it was introduced to increase the tax base.

|

|

Property Tax |

People who own land and or developed property (land with a dwelling on it) pay tax each month, or each quarter, to the local authority. This is the chief form of income for a municipality.

|

|

Corporate Tax |

Companies and Close Corporations pay tax at a relatively high rate. Some argue that companies should be exempt altogether in order to stimulate economical growth. In some countries and/or regions of countries companies are given a tax break, or tax window they either pay much less, nothing at all or less than usual for a period of time. The regions of the world which do exempt companies from all forms of taxation find they are economical powerhouses Hong Kong is an example.

|

|

Customs and Excise duty |

This is income derived from charges for imported equipment, luxury goods, imported tobacco, alcohol, etc.

|

|

State Enterprises |

Sometimes the state runs profitable enterprises that generate income which the government of the day may then use as a source of income. Forestry is one example.

|

|

Levies |

Registration fees; rent from letting state property.

|

|

License Fees |

Television, motor vehicle and other licenses.

|

|

Penalties; bail money |

Fines for criminal offenses.

|

|

Capital Gains Tax |

This is relatively new to South Africa. This amounts to approx 25% of the profit on capital appreciation, such as when you sell a property. Your primary residence (the house you live in with your family) is, however, exempt in that the first R2,000,000 profit from a sale is not taxable.

|

Where it all goes (this, of course, varies from year to year):

Service |

% of Budget |

Education |

20 |

Health |

12 |

Interest on Debt |

20 |

Welfare |

9 |

Other Social Services |

2 |

Contingency reserve |

1 |

Justice Police & Prisons |

10 |

Defence |

6 |

Economic Services |

9 |

Government Services |

11 |

Note that the amount to keep the administration of the government going is more than half the amount spent on Education: too much, some say. Sadly the interest payments for SA's debt actually equals the amount spent on education. Imagine if we spent half the amount on prisons - we would have enough to increase the education budget by 25%! Or we could increase the health budget by nearly 50%.

And so now you should have a much better picture....

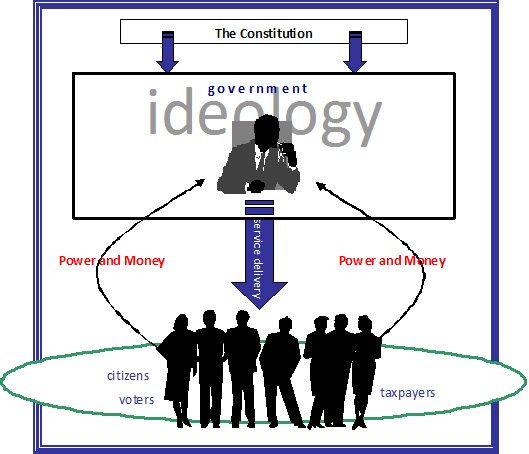

Lets take another look at the diagram we compiled in Module One showing the relationship between the citizen, the government, its ideology and power.

We can now clearly see that the government needs more than just power from us.

In fact it does its best to get far more than this.

It also needs money!

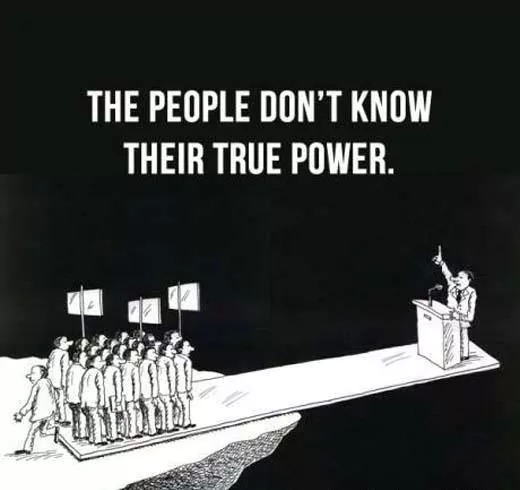

This is why votes are so important - without them, governments can do nothing. It is also why every single vote has power and why communities and governments are disappointed when people do not exercise their vote: their power.

Voters have very little control over the money they give to the government, but it is vital that each voter sees to it that the appropriate Elected Official uses his/her power and money for the benefit of the entire community.

Instead of citizens believing that Elected Officials have all the power; instead of feeling small, like pawns on a chessboard - instead of believing that they can do nothing, believing what you have learnt here in this course should make you realise that rather than feeling small and powerless, it is YOU that carries all the power in South Africa through your vote. Use it carefully...

CONSIDER THIS CAREFULLY:

Did you hear a siren today?

IT'S MONEY OUT OF YOUR POCKETS ... If people in this accident suffer from severe injuries, it will cost YOU approx R290 000 to put each one back in their place of work after hospitilisation and rehabilitation.

Think about it. South Africa has one of the highest road death rates in the world: 1000 a month. Sweden is less than 400 a year.

Imagine the cost to the country - to You.

Did you stroll through a park; enjoy public transport?

You helped build these, through your taxes; they belong to YOU as much as they are public. Do you take care of public facilities? The next time you see someone damaging public property, know that YOU will be paying for the damage.

We should all take part responsibility, because we have part-ownership.

Think about it - if you don't, it's

IT'S MONEY OUT OF YOUR POCKETS...

The Bottom Line:

The government is us; we are the government,

you and I.

Theodore Roosevelt (18581919), President of USA

And this is why I truly believe that if ordinary citizens like you and I fully understood what this Economics-Awareness course has taught us: understood that governments can operate only with our permission; that in fact WE hold all the power and the money they need, then true ownership will take place.

And this understanding can only come about with education itself ...

Education is the most powerful weapon which you can use to change the world.

President Nelson Mandela

Congratulations

You have completed

Module Three

It's been a pleasure working with you. If you are a Public Administration/Public Finance student, you will find it MUCH easier to complete the course at college, and you will do so much better in the examination had you not completed this programme.

I hope you enjoyed it...

if you have any questions or would like to comment, please contact me

Michael Klerck

Home

What did you do with your vote today?

Hey, Mr/s elected official, public servant, what did you do with my money today?

+

+

=

=